According to a recent article in HVP SME’s are losing more than £7 billion a year from missed payment opportunities. A research report from Barclaycard reveals SME’s are losing money by not offering customers the opportunity to pay by debit or credit card.

Despite three quarters of all retail transactions across the country now being carried out in this way, 58% of SMEs are not currently able to take card payments. Of these, a quarter admit this has resulted in lost sales opportunities.

However, new mobile payment software options are now available which offer SME’s the opportunity to take payments from customers whilst on the go.

For example Barclaycard Anywhere allows businesses to take secure card payments wherever they are. By incorporating a secure card reader which attaches to a smartphone or tablet it uses a purpose-built app to accept card payments using chip and PIN technology. There are no monthly fees or contract tie-ins you just pay for the card reader and a 2.6% fee per payment. For more information please visit www.barclaycardanywhere.co.uk

Also, PayPal Here allows you to accept credit and debit cards via a card reader as well as PayPal, log cash and cheque payments, issue invoices and send instant receipts. There’s a one off charge for the card reader then 2.75% for every payment you accept. For more information please visit www.paypal.com

PayPal Here

About Us

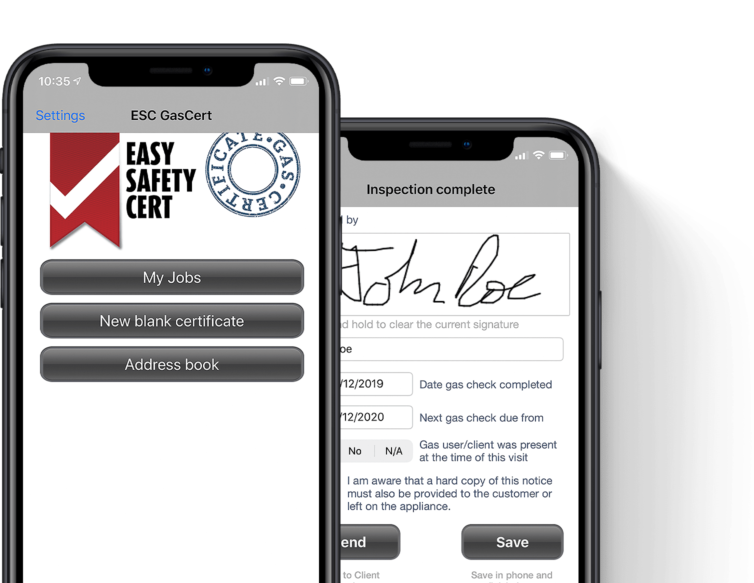

Easy Safety Cert provide Gas Safe registered engineers with a complete gas certificate software system. Users can create, send and store gas certificates using their smartphone or tablet. For more information please visit www.easysafetycert.co.uk

Get the latest updates direct to your inbox